Don’t be afraid of $100 million in tax hikes! Textile and clothing companies actively responded to the lawsuit and resolved the crisis!

In the early morning of July 11, 2018, Beijing time, the Office of the U.S. Trade Representative issued an announcement announcing that in accordance with President Trump’s order, it plans to impose an additional 10% tariff on Chinese export products under 6030 U.S. Customs Tariff Numbers, involving the value of the products. About $200 billion. This tariff measure is a new part of the US Section 301 measures.

Jincheng Tongda International Dispute Resolution Team Strongly recommends that affected Chinese companies (such as textiles, clothing) take immediate action, unite with U.S. importers and downstream users, and actively use July-August During the public comment process, we strive to exclude the products involved from the final tax list.

Click on the QR code to view relevant announcements from the Office of the United States Trade Representative

Situation Overview

In addition to the list released on July 11, 2018, previous 301 measures against China also include:

1. An additional 25% tariff on Chinese products worth US$34 billion, involving 818 customs tariff numbers (effective on July 6, 2018, and the U.S. Trade Representative announced and started the exclusion application process on the same day);

2. Increase tariffs on US$16 billion worth of Chinese products, with rates to be determined, involving a total of 284 customs tariff numbers (not yet in effect and currently in the public comment stage).

According to an announcement from the Office of the United States Trade Representative, the new tariff measures are an “adjustment to Section 301” measures in response to the Chinese government’s simultaneous imposition of retaliatory tariffs on U.S. exports on July 6. “.

The list of US$200 billion products released this time involves 6,030 products with U.S. 8-digit tariff numbers. Combining the previous US$34 billion and US$16 billion, there are currently 7,132 US 8-digit tariff numbers involved, accounting for 63.39% of the total 11,251 8-digit tariff numbers in the US. The products involved this time cover a very wide range, and bulk products exported from China, such as textiles and clothing, have become key targets.

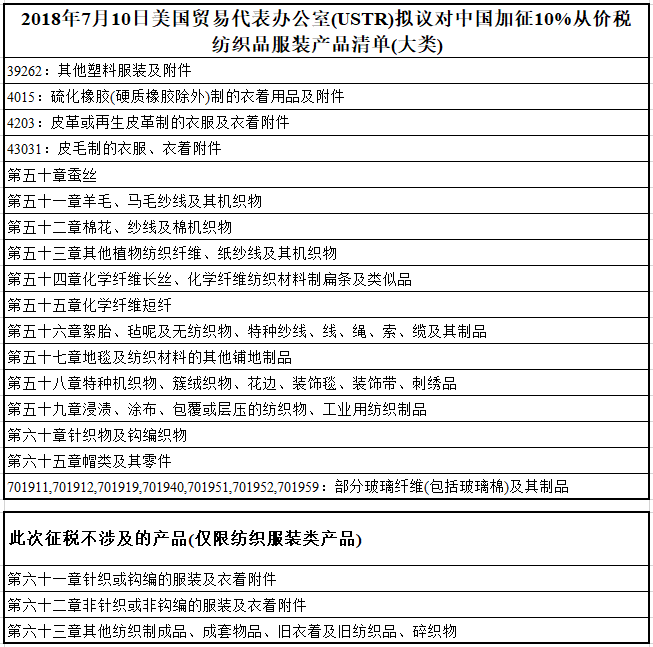

The situation of textile and apparel products with 6030 tariff codes in this list is as follows:

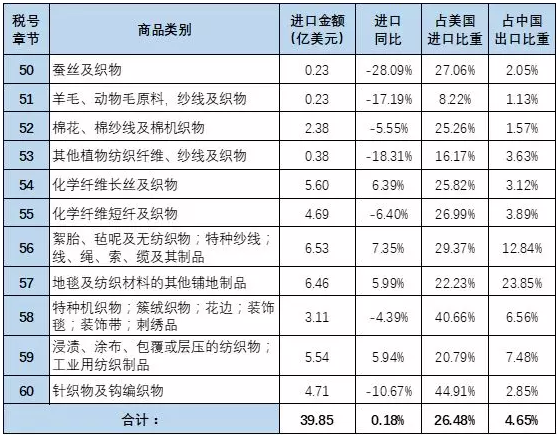

According to preliminary compilation by the China Textile and Apparel Industry Federation, approximately 927 textile products (annual exports to the United States of approximately US$4 billion) are involved. This is the biggest challenge that my country’s textile industry has encountered in foreign trade since the United States and Europe canceled textile and clothing quotas.

According to U.S. OTEXA statistics, China’s textile and apparel exports to the United States totaled US$38.74 billion in 2017. Among them, exports of clothing were US$27.03 billion, and exports of textiles and manufactured products were US$11.71 billion (including US$220 million of yarn, US$1.84 billion of fabrics, and US$9.64 billion of home textiles, industrial textiles and other manufactured products).

According to preliminary compilation by the International Trade Office of China Textile Federation, the products subject to the 10% tariff increase this time have more than 900 tax numbers according to US standards, covering a very wide range, involving almost all products in Chapters HS50-60. Including all yarns, fabrics/fabrics of various raw materials (cotton, wool, silk, hemp and chemical fibers), as well as industrial textiles and some textile machinery products, the annual export value to the United States is approximately US$4 billion. This list does not include clothing products and most home textiles.

According to ITC standards, the export amounts of Chapters HS50-60 involving tax increases to the United States in 2017 are as follows:

It is worth emphasizing that the United States is focusing on the mid- and upper reaches of my country’s industrial chain this time. No additional tariffs have been imposed on clothing products and most home textiles sold directly to U.S. consumers.

Public Comment Process

Regarding this new list of proposed tariffs, the Office of the U.S. Trade Representative invited interested parties to provide public comments on the list in the announcement. If certain conditions are met, the products can be excluded from the final tax list. outside.

Jincheng Tongda International Dispute Resolution Team Strongly recommends that affected Chinese companies take immediate action, unite with U.S. importers and downstream users, actively use this procedure, and strive to remove the products involved from them. excluded from the final tax list. For the list of products worth US$34 billion, the products to be taxed were reduced from 1,333 tariff numbers to 818 tariff numbers through the public comment process, and 515 tariff numbers were deleted. It is best for those who comment and participate in hearings to be purely American entities or Americans. Speeches by Chinese-backed entities such as Chinese-funded institutions in the United States cannot have substantial influence.

Reasons for exclusion that can be raised during the public comment stage

Regarding whether to ultimately impose taxes on related products, the U.S. Trade Representative mainly considers:

1. Whether the product has alternative sources outside China (if it can only be supplied in China, it is more likely to be excluded);

2. Whether the tariffs will seriously harm the U.S. company that applied for it or the interests of the United States (if not importing the product will lead to the loss of a large number of jobs in the United States, exclusion is more likely);

3. Does this product have any impact on relevant industries in China?The plan has important strategic significance (if the relevant products are not related to Made in China 2025, exclusion is more likely).

Arrangement of Public Comment Procedure

The specific timetable for the public comment process is as follows:

July 27, 2018 Deadline to apply for a public hearing. When submitting the application, the applicant shall also submit a summary of the hearing testimony and may also submit pre-hearing written comments. Requests to participate in the public hearing should be submitted on regulations.gov under docket number USTR-2018-0026.

August 17, 2018 Deadline for submission of written comments. Written comments should be submitted on regulations.gov under docket number USTR-2018-0026.

August 20-23, 2018 Public hearing.

August 30, 2018 is the deadline for submission of rebuttal comments after the hearing.

(Based on the review and implementation procedures for the previous $34 billion product list, for the $200 billion product list, it is expected that an updated final list for taxation will be released in late September, and an additional 10% tax will be imposed in early October. % tariff.)

Business response suggestions

Accurately determine whether the product is in this new list of proposed tariffs

The most important point for enterprises in the response process is to clarify whether the products they export to the United States are on the list. Since the list published by the U.S. uses U.S. tariff numbers, which are not consistent with Chinese tariff numbers, we recommend that companies follow the following methods to investigate.

1. Confirm the first six digits of the Chinese tariff number for products exported to the United States, and conduct a preliminary screening based on the six-digit tariff number to see if it falls into the list (since the first six digits of the customs tariff number are common around the world, you can This is the standard for preliminary screening).

2. If the product falls into the list according to the 6-digit tariff code, then further check the product description under each 8-digit tariff number under the 6-digit tariff code in the list. If the exported product meets the relevant description, it is initially confirmed that the product falls into the list.

3. Send the U.S. tariff number and description in the involved list to the U.S. importer for final confirmation.

If a product falls on the $200 billion product list, companies should take immediate action to exclude related products through the review process

Immediately Contact U.S. importers to submit comments opposing the tax (deadline is August 17) and apply to participate in the public comments to be held from August 20 to 23 hearing (the deadline for applying to participate in the hearing is July 27) (it is best for those who comment and participate in the hearing to be purely American entities or Americans, Chinese-funded institutions in the United States, etc. Speeches by Chinese-backed entities cannot have substantial influence).

Submit an application for a hearing before July 27: U.S. importers need to submit an application for a hearing. When submitting the application, the applicant shall also submit a summary of the hearing testimony and may also submit pre-hearing written comments. Requests to participate in the hearing need to be submitted on the www.regulations.gov website under case number USTR–2018–0026. The application needs to be sent to [email protected] at the same time.

Submit written comments before August 17. Written comments should be submitted at www.regulations.gov under docket number USTR–2018–0026. Comments should include:

1. Whether specific customs tariff numbers should be retained, removed or added to the proposed tariff list, and whether the corresponding tariff measures are feasible to eliminate China’s relevant behaviors and policies for the customs tariff numbers that are considered to be removed or added. or effective, and whether it will cause a disproportionate negative impact on the U.S. economy, including on small and medium-sized businesses and consumers.

2. Should the proposed tariff rate be increased and to what extent?

3. The appropriate level of the total trade amount involved in the proposed tariffs.

August 20-23, U.S. importers are requested to attend the hearing on time. Speaking at the hearing will help keep products off the tax list. The corresponding person may not speak for more than 5 minutes at the hearing.

Submit written rebuttal comments (if any) before August 30.

Patiently wait for the U.S. Trade Representative to finally issue a revised tax list for this new tax list.

Based on the review and implementation procedures for the previous $34 billion product list, it is expected that the updated list for taxation will be released in late September for the $200 billion product list, and an additional 10% tax will be imposed in early October. of tariffs.

If your company needs to respond to a lawsuit and resolve a crisis! Please contact: Beijing Jincheng Tongda Law Firm International Dispute Resolution Team

AAAZXCASFWEFERH

Disclaimer:

Disclaimer: Some of the texts, pictures, audios, and videos of some articles published on this site are from the Internet and do not represent the views of this site. The copyrights belong to the original authors. If you find that the information reproduced on this website infringes upon your rights, please contact us and we will change or delete it as soon as possible.

AA