Actively planning for industrial transformation, Nanjing Chemical Fiber (600889.SH) encountered secondary market investors “voting with their feet.”

On the secondary market, in the 10 trading days since December 10, Nanjing Chemical Fiber’s stock price fell for 9 days, with a cumulative decline of 41.43%.

Why is the industrial transformation of Nanjing Chemical Fiber not recognized by investors? It turned out that the company was implementing industrial transformation through acquisitions, and the appreciation rate of the underlying assets was a bit high.

According to the announcement, Nanjing Chemical Fiber plans to acquire 51.91% equity of Shanghai Yueke New Materials Co., Ltd. (referred to as Shanghai Yueke) in cash for a transaction price of 389 million yuan. Shanghai Yueke’s main products are PET structural foam sandwich materials and wind turbine blade molds. After the acquisition, Nanjing Chemical Fiber will realize dual main business operations.

In this acquisition, the assets of the target company were valued at 751 million yuan, with an added value of 570 million yuan, and a value-added rate of more than 3 times. And in 2019, the target company was in a loss-making situation and had just achieved profitability in the first eight months of this year.

Nanjing Chemical Fiber has entered the A-share market as early as 1996. The company is mainly engaged in the production and sales of viscose filament, and its product structure is relatively simple. In recent years, the company’s operating performance has been less than ideal. From last year to the first three quarters, it was in a state of loss.

While Nanjing Chemical Fiber is trying to transform its industry through the above-mentioned mergers and acquisitions, it also hopes to turn losses into profits this year. Whether it can do so remains uncertain.

Regulatory inquiry on the sustainable profitability of the underlying assets

Twice in one year, Nanjing Chemical Fiber planned to acquire the same underlying asset. Nanjing Chemical Fiber’s “perseverance” attracted regulatory inquiries .

On June 2 this year, Nanjing Chemical Fiber suspended trading and announced that it planned to acquire control of Shanghai Yueke through the issuance of shares and payment of cash, and to raise supporting funds. According to the announcement on the progress of the trading suspension, the relevant transactions are expected to constitute a major asset restructuring. On June 16, the company announced the termination of the above-mentioned major asset restructuring. It took less than half a month from the planning of the acquisition to the termination of the acquisition.

After half a year, Nanjing Chemical Fiber once again announced its intention to acquire Shanghai Yueke.

On the evening of December 8, Nanjing Chemical Fiber announced that it planned to acquire Ningbo Xinju Investment Partnership (Limited Partnership) (referred to as Ningbo Xinju), Daqing Oilfield Pegasus Co., Ltd. (referred to as Daqing Pegasus), etc. in cash 12 counterparties hold a 51.91% stake in Shanghai Yueke, with a transaction consideration of approximately 389 million yuan. After the acquisition is completed, Shanghai Yueke will become a subsidiary of Nanjing Chemical Fiber Holding and be included in the scope of consolidated statements.

After the completion of the above transaction, Nanjing Chemical Fiber also plans to purchase the 38.09% stake in the target company that will be held by Shanghai Zhongju, Zhengyun Investment and Daqing Pegasus. However, this deal is set up with conditions.

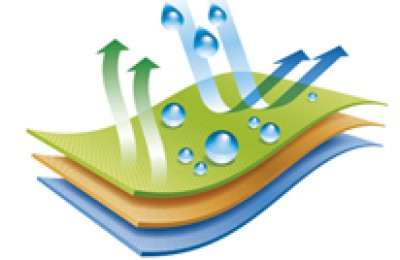

Shanghai Yueke was established on June 23, 2006. It is mainly engaged in the production, research and development and sales of core material products, mold products, accessories and other products. Among them, core material products are the core products of Shanghai Yueke, mainly PET structural foam sandwich materials, which can be widely used in energy and environmental protection (wind power blades), construction engineering, transportation, aerospace, sports and leisure and other fields. Shanghai Yueke also customizes high-precision composite molds according to customer needs.

There is a high premium in this transaction. The assessment base date is August 31 this year, and the assessment result using the income method is used as the assessment conclusion. Without taking into account the discount for the lack of liquidity of the equity, the assessed value of Shanghai Yueke’s total shareholders’ equity is 751 million yuan, an increase of 570 million yuan compared with its book net assets of 181 million yuan, with a value-added rate of 314.55%. As agreed by all parties to the transaction, the value of 100% equity of the target company was determined to be 750 million yuan, and the corresponding value of acquiring 51.91% equity was 389 million yuan.

Under the high premium, the counterparty also made corresponding performance commitments, that is, from 2020 to 2022, Shanghai Yueke’s net profit after deducting non-recurring gains and losses (referred to as deducting non-net profit) was respectively They are 60 million yuan, 70 million yuan, and 80 million yuan, totaling 210 million yuan.

Data show that as of August 31 this year, Shanghai Yueke had total assets of 358 million yuan, total liabilities of 216 million yuan, and net assets of 141 million yuan. In 2019 and the first eight months of this year, it achieved operating income of 87.3569 million yuan and 126 million yuan, net profits of -17.4378 million yuan and 28.4981 million yuan, and non-net profits of -18.6574 million yuan and 28.6206 million yuan.

It was still at a loss last year. In the first eight months of this year, Shanghai Yueke’s operating income significantly exceeded last year’s full year, and its net profit has turned a profit.

In response to this acquisition, the exchange issued a letter of inquiry: Was the reason for the termination of the previous planned acquisition of the target company due to major obstacles? Are the significant fluctuations in the target company’s operating performance reasonable? Are high performance promises based on evidence and achievable?

Nanjing Chemical Fiber responded one by one. The company said that from 2017 to 2018, Shanghai Yueke mainly produced and sold wind turbine blade molds, ancillary products, pipe fittings, composite panels, etc. and processing business. Starting in 2018, Shanghai Yueke’s various business orders decreased and its performance declined. It shifted its business focus to the research and development of PET structural foam materials. At the end of 2019, Shanghai Yueke achieved the industrialization conditions for PET structural foam materials with a yield rate of more than 90%, and successively received orders from Sinoma Technology, Zhangjiagang Diabo, etc. In the first eight months of this year, Shanghai Yueke took the production and sales of core material products (mainly PET structural foam materials) as its core business, and related income accounted for more than 60% of its main business income. Therefore, the target company has sustained profitability.

It has been losing money for two consecutive years after deducting non-net profits

The acquisition of Shanghai Yueke entrusts Nanjing’s dream of transforming the chemical fiber industry and turning losses into profits.

The predecessor of Nanjing Chemical Fiber was built and put into production in 1964.Nanjing Chemical Fiber Factory. At present, the company’s main business is the production and operation of viscose fiber and tap water, and its business structure is relatively simple.

As of the end of June this year, Nanjing Chemical Fiber has an annual production capacity of 80,000 tons of viscose staple fiber. The company’s water plant is located in Yanziji, Qixia District, Nanjing City, and has a landscape water supply capacity of 150,000 tons/day. The landscape water produced is used for diversion and water replenishment of inland rivers such as Xuanwu Lake, Jinchuan River System, and Beishili Changgou.

In recent years, the international trade situation has been complicated. Especially since this year, due to the impact of the COVID-19 epidemic, the prosperity of the textile and chemical fiber industry has declined sharply, textile exports have shrunk, and the operating rate of downstream viscose staple fiber enterprises has dropped significantly. The price of staple fibers has hit a low in more than 20 years, and Nanjing Chemical Fiber is facing a more severe operating situation.

From the perspective of operating performance, Nanjing Chemical Fiber’s overall operating performance has been poor in the past 10 years. In 2010, the company achieved operating income of 1.004 billion yuan, net profit of 104 million yuan, and non-net profit of 46 million yuan, representing year-on-year increases of 34.35%, 50.38%, and 3367.40%. Since then, business performance has gone downhill.

In 2015, Nanjing Chemical Fiber achieved operating income of 1.518 billion yuan and net profit of 458 million yuan, but after deducting non-net profits, it was only 17 million yuan. In 2017, the company achieved operating income of 1.607 billion yuan, a year-on-year decrease of 3.47%, and a net profit of -303 million yuan, its first annual loss since its listing. In 2018 and 2019, operating income was 991 million yuan and 658 million yuan, a year-on-year decrease of 38.36% and 33.60% respectively; net profit was 60 million yuan and -131 million yuan, a year-on-year change of 102.05% and -2216.67%; excluding non-net Profit has been in loss for two consecutive years, at -96 million yuan and -169 million yuan, a year-on-year decrease of 295.97% and 76.33%.

To sum up, in the past three years, Nanjing Chemical Fiber has basically been in a state of preservation.

In the first three quarters of this year, the company achieved operating income of 245 million yuan, a year-on-year decrease of 52.04%; net profit of -22 million yuan, a slight increase of 7.85% year-on-year; non-net profit after deducting -117 million yuan, a year-on-year decrease of 8.359 %, the main business losses continued to expand.

Obviously, judging from the operating performance data of the first three quarters, the current main business has not yet recovered significantly, and it will be difficult for Nanjing Chemical Fiber to turn around losses this year by relying on its own business alone. Relying on the capital market function to turn losses into profits has become one of Nanjing Chemical Fiber’s choices, and its industrial transformation is also imminent.

In fact, Nanjing Chemical Fiber has repeatedly expressed its willingness to promote the layout of the secondary industry.

In this year’s semi-annual report, Nanjing Chemical Fiber stated that the company regards emerging industries such as new materials, energy conservation and environmental protection, and high-end intelligent equipment manufacturing as its second main business expansion focus, and works closely with relevant intermediaries to jointly investigate , visited a number of companies, and conducted in-depth research on giving full play to the role of Nanjing Chemical Fiber Listed Company’s financing platform, focusing mainly on the market development prospects, core technologies and competitiveness, management team stability, environmental protection conditions, and operating performance of the target companies. On other aspects, we consulted the target company on market valuation, expectations of listed companies and controlling shareholder Xingong Group, and other work matters.

This shows that Nanjing Chemical Fiber is actively planning for industrial transformation and promoting the “two-legged” walking plan.

However, whether this acquisition of Shanghai Yueke can meet the expectations of industrial transformation remains to be tested by time. </p