“In 2021, the company will strive to achieve a total net profit increase of more than 10% from the clothing segment and real estate business compared with 2020.” Recently, Li Hanqiong, general manager of Youngor (600177.SH), said at the 2020 performance briefing conference that the company will Seize the opportunity of consumption upgrading, optimize the fashion industry, and enhance brand competitiveness.

At the performance briefing meeting, most investors were concerned about Youngor’s future investment projects and profits. In this regard, Chairman Li Rucheng said that Youngor is gradually focusing on financial investment Turning to strategic investment, investment only focuses on areas that the company is familiar with.

The company’s 2020 annual report also mentioned that it will “gradually withdraw from existing financial equity investment projects, appropriately participate in short- and medium-term investment projects with good liquidity, and continue to pay attention to the main Investment and M&A opportunities in large consumer industries related to the industry.”

Youngor’s 2020 annual report shows that last year’s operating income was 11.47 billion yuan, a year-on-year decrease of 7.61%; the net profit attributable to shareholders of listed companies was 7.23 billion yuan, a year-on-year increase of 82.15%; operating activities The net cash flow generated was 2.2 billion yuan, a year-on-year decrease of 20.21%.

In terms of sectors, Youngor’s investment sector achieved a net profit of 4.655 billion yuan in 2020, far exceeding the company’s two major businesses, clothing and real estate, with net profits of 960 million yuan respectively. and 1.657 billion yuan. Thanks to investment income, the company achieved a net profit of 7.236 billion yuan despite a revenue decline of 7.61%, a year-on-year increase of 82.15%. It ranked among the best among listed clothing brand companies in the same year, and its net profit was equivalent to Anta (02020. HK), Li Ning (02331.HK) and 361 Degrees (01361.HK). The total net profit of the three companies.

The revenue from the main business of clothing (including shirts, suits, pants, tops, etc.) is still higher than that of the previous year declined, but gross profit margin increased.

Based on the above, profits attributable to shareholders of listed companies have increased, main business income has declined, gross profit margin has increased, and stores are still expanding. Youngor’s business experience is really intriguing.

In fact, Youngor Group has been relying on “stock speculation” to maintain net profit growth in the past 20 years. Chairman Li Chengru once said: The group’s investment has made money in the manufacturing industry for 30 years.

Therefore, Youngor is also known as the “investment bank” in “sheep’s clothing” in the industry.

However, in 2019, Youngor shouted the slogan of focusing on the main business of clothing and no more new financial investments. For this reason, it did not hesitate to reduce its holdings of 296 million shares in Bank of Ningbo in 2020. Cash out 10 billion yuan to support the main business.

So, does Youngor’s store growth this year mean that it has successfully returned to its main business? We might as well explore the truth from the minutiae.

Not doing his job, he became a stock god

Speaking of Youngor, it was founded in 1979 Taking advantage of the spring breeze of reform, Li Rucheng entered the clothing field that was just starting at that time and opened a clothing factory.

In 1993, Qingchun Garment Factory began to take the branding route and changed its name to Youngor. Catching up with the golden period of the industry, Youngor went public in just five years.

At the same time, Shanshan Shares, Announcement Bird, and Yongpai Clothing were also popular across the country, and they completed primitive accumulation simultaneously.

Until 2012, the rapid growth of China’s clothing industry ended. At that time, the growth rate of retail sales and sales volume of clothing products of hundreds of key large enterprises in the country was declining. In 2013, both volume and price continued to fall. In 2014, clothing retail sales showed negative growth for the first time, and then in 2015, retail sales also showed negative growth for the first time.

It is becoming increasingly difficult to make money, and industry leaders are beginning to seek diversified development.

As early as 1999, the year after its listing, Youngor began to test the waters of equity investment. Sure enough, when Youngor encountered an industry bottleneck, it did not dwell too much on upstream and downstream pressures, but chose to get the group out of low-value work as soon as possible.

In 2008, Youngor established Kaishi Investment Management Company, specializing in investment business. In 2012, Youngor’s investment business transformed from financial investment to industrial investment, and successively invested in Bank of Ningbo and Zheshang Financial Insurance. and other financial companies.

In the field of new energy, Youngor has also invested in Ningbo Kunneng Photovoltaic Technology, including listed companies Lianchuang Electronics, CITIC Limited, Ningbo Bank, Chuangye Wellcome, Jinzhengda, etc., and finally Amazingly there is also a zoo and tour company.

With many excellent stock trading records, Youngor has been dubbed “China’s version of Berkshire Hathaway” by investors.

Investment allowed Youngor to take off, but it had nowhere to put its scattered and heavy assets.

Return to the main business and prepare for a rainy day

In the beginning, eggs were not put in one basket , hoping to achieve synergy between investment and its main business of clothing.

For example, earn profits through the clothing sector, then invest the profits in the real estate sector to obtain stable cash flow, and finally invest the funds in the stock market to achieve cash flow synergy. .

However, in fact, after ten years of glory, the profits of the clothing sector are not enough to meet the needs of the real estate business, and the introduction of purchase restriction policies further hinders the return of funds.

In 2011, Youngor had to resort to large-scale debt to relieve financial pressure.Youngor has always claimed that the apparel business is its main business. However, judging from various aspects such as revenue, profit contribution and market position, the process of returning to the main business is not smooth.

In October 2016, Li Rucheng announced that Youngor would undergo a business transformation and would take five years to create another Youngor. He closed small stores and opened big stores, and invested heavily in building “Youngor Home”. It took 5 years to create 1,000 self-operated stores with a turnover of more than 10 million yuan.

But the news about “Youngor House” and “big store strategy” quickly faded away.

In 2021, Li Rucheng once again emphasized the focus on three things: diversified industry integration and trade-offs, brand digital upgrades, and second-generation inheritance, all interlocking.

Side business is at the bottom, stores remain stable

Looking back carefully, in recent years There are indeed some changes in Youngor this year, such as fashion experience hall, hemp industry research institute, smart middle station, live broadcast of goods, inviting Armani designers… there are endless tricks.

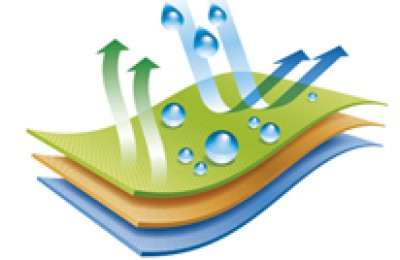

According to the media, Youngor’s clothing business has achieved coverage of the entire industrial chain, and the upstream has extended to the fields of cotton yarn planting and research and development; in the supply system, a “self-production + generation” model has been formed. It has also formed a diversified brand matrix represented by YOUNGOR, Hart Schaffner Marx, MAYOR, and Hanma Family, covering mid-to-high-end and high-end.

According to Youngor’s investment map in recent years, it can be seen that the company is involved in the banking, clothing, electronics, and real estate industries. Tianyancha data shows that Youngor currently participates in holding 91 companies. As of the end of 2020, Youngor’s cumulative investment amount was 25.907 billion yuan, with a market value of 29.327 billion yuan.

In the letter to shareholders in the 2020 annual report, Li Rucheng said that Youngor cannot avoid three major changes: the integration and trade-offs of diversified industries, the digital and intelligent transformation of traditional industries, and the second-generation inherited. At this performance meeting, Li Rucheng still said that “the current clothing, real estate, and investment businesses are all undergoing transformation” and “the company is cultivating its own brands and cooperative international brands.”

On January 29, Youngor announced that it would invest 2.8 billion yuan to establish Youngor Fashion (Shanghai) Technology Co., Ltd., with the main direction of cultivating new brands and exploring cooperation with new brands. In addition, the company is cooperating with international brand Helly Hansen to explore the Chinese market.

According to the first quarter report, Youngor’s fashion segment business has improved, with revenue rising 20.60% year-on-year to 1.688 billion yuan, and net profit attributable to the parent company rising 96.61% year-on-year to 271 million yuan; The real estate business fell by 76.86% due to the lack of trading profits during the reporting period; the investment business fell by 46.53% year-on-year due to the decrease in shareholding ratio and the decrease in investment income of Bank of Ningbo under equity method accounting. </p